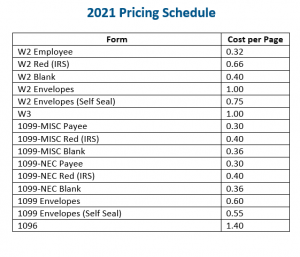

Pricing Schedule for 2021 Tax Forms

Tax Form Orders Due: October 29, 2021

This year you will complete your order online. Please carefully review these important updates.

CLICK HERE TO DOWNLOAD INSTRUCTION PDF.

IMPORTANT: The Tax form order has been completely revised this year. Previously, Horizon requested employee and vendor counts to determine the quantity of forms needed. This year’s order should be based on actual forms (pages) needed. Our ordering method has been changed to accommodate the increase in electronic filing. Each paper form now requires the exact number of forms you need this year.

Each form will show in the description:

- the form type

- the price (before quantity discounts)

- how many are needed per employee or vendor

For Example:

- Employee W-2 ($0.32 per form) ONE FORM PER EMPLOYEE – four part form/blank with instructions on back. Please order 1 form for each employee receiving a paper copy.

- IRS RED W-2 Form ($0.66 per form) ONE FOR EVERY TWO EMPLOYEES – two part form. If paper filing you need 1 for every 2 employees. Example: If you have 45 employees: 45/2=22.5 round up to 23 forms needed. You may add additional forms for test printing, printer malfunctions / misfeeds.

Can you use last year’s extras? Each form description will state if you can use leftover forms from last year or not. Some forms are year-specific and cannot be reused. Forms such as the 1099 NEC have major changes this year, so you will need new forms and envelopes. However, some forms that are blank on each side, as well as some envelopes, are the same as previous years. Please read descriptions carefully.

Form 1099 NEC: The form 1099 NEC has been completely redesigned by the IRS. It now contains 3 vendors per page, which is a significant difference from the normal 2 vendors per page.

Example: If you have 47 vendors, (47/3 = 15.6) Round up to 16 needed and then add a couple for tests and misfeeds. This also means that the envelopes used for the 1099 MISC will NOT fit the new edition. You will need to order separate envelopes for the NEC.

NOTE: If you have vendors that receive both a MISC and a NEC, you can put both in a MISC envelope, placing the NEC behind the MISC.

After submitting your request: You will have the option to Print or Save a PDF. Please print a copy for your records. You will receive a confirmation email from Horizon within a few days of your submission. If you have not received your confirmation within 7 days, please contact Darci at 814-535-7810 to verify that it was received.

Need help determining quantity? If you’re not sure how many forms you need, you can go to each area within the Horizon programs and pull the 2021 information:

- Pull W2 data in payroll

- Pull 1099 data in Section 8

- Pull 1099 data in Financials

We recommend adding extra forms for possible additions between now and the end of 2021. In January 2022, you will pull again to update these to year end actuals. You may also review your 2020 packing slip and/or invoice to see how many were ordered in 2020.

ADDITIONAL INFORMATION

- The Horizon 2021 Payroll End of Year Guide will be made available in mid-December. The guide includes information on closing payroll and tax changes for 2022.

- The IRS introduced the 1099 NEC last year and the process will be the same as last year.

- Any vendor that has an amount in what was formerly 1099 MISC Box 7 Non-Employee Compensation is now reported on form 1099 NEC.

- 1099 NEC forms are now 3 vendors per form. To order, divide by 3 then round up (add some extra) Example: having 47 vendors 47/3 = 15.6 Round up to 16 needed, add a couple for tests and misfeeds.

- If paper filing, the 1099 NEC is due in the mail and postmarked by January 31, 2022.

- If filing electronically, the 1099 NEC is also due by January 31, 2022.

- Paper file by February 28, 2022 or e-file by March 31, 2022.

- Pennsylvania Submissions: if you will submit 10 W-2s, PA requires that you submit online (E-Tides) for both W2 and 1099.